Tax Audit Section 63 & Form 3CD Guide

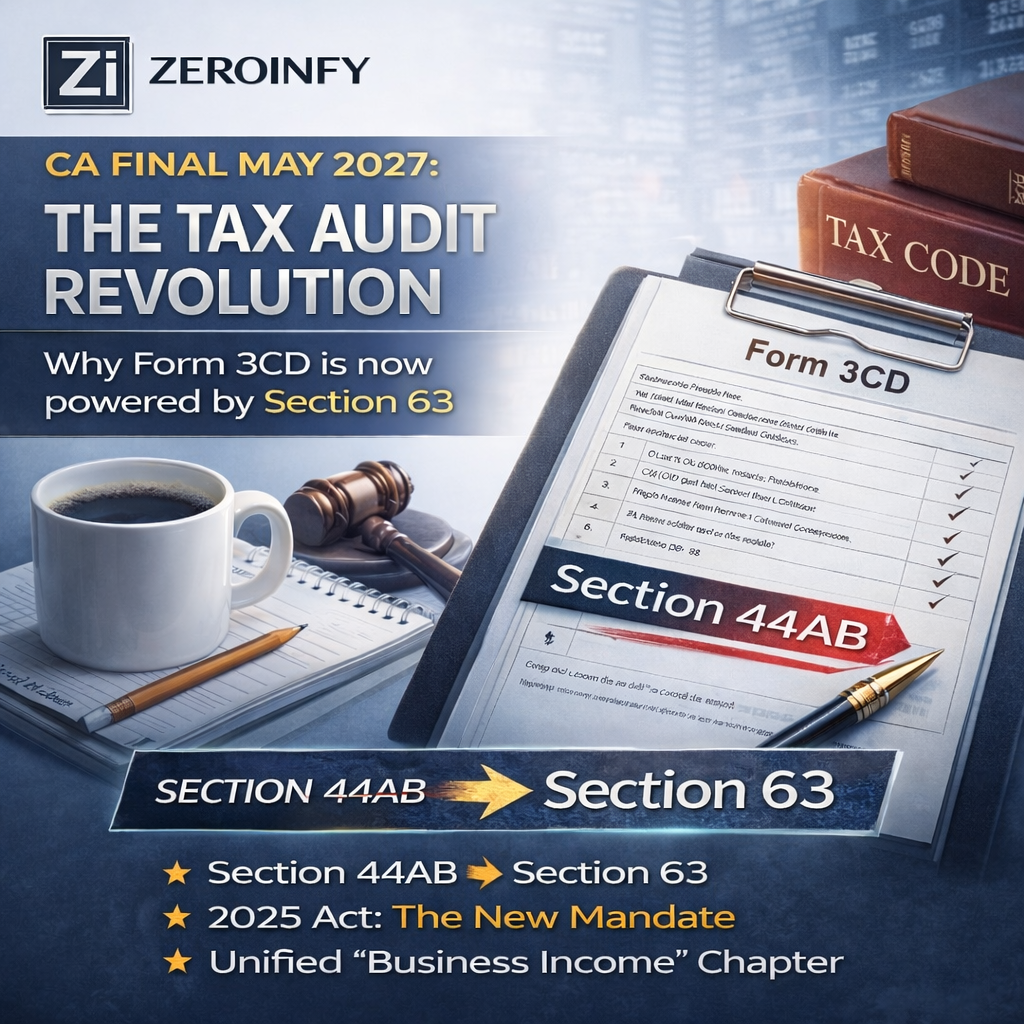

If you are currently in your articleship, you probably spend hours filling out Form 3CD. You know the clauses by heart, but do you know the new law behind them? For the May 2027 attempt, the legal “engine” of your tax audit has been replaced.

The Legal Anchor: Section 44AB vs. Section 63

In the 1961 Act, Section 44AB was the mandate. In the Income-tax Act, 2025, that mandate has moved to Section 63. This isn’t just a number change; it’s a structural realignment where audit provisions are now part of the unified “Business Income” chapter.

1. Form 3CD: The Practical Connector

Students often ask: “Does the form change if the section changes?” While the reporting structure of Form 3CD remains largely intact to ensure continuity, the references within your report must shift. If you reference Section 44AB in a May 2027 exam, you are referencing a repealed law.

2. Exhaustive Mapping: The “Audit Trail”

To score high marks, you must show the examiner that you can link a 3CD Clause to a New Act Section. Here is the exhaustive mapping for the most critical areas:

| Audit Area | Form 3CD Clause | The “New” Legal Link (2025 Act) |

|---|---|---|

| Audit Mandate | Clause 8 | Section 63 (The new 44AB) |

| Method of Accounting | Clause 13 | Section 11 (ICDS Compliance) |

| Depreciation | Clause 18 | Section 31 (Old Sec 32) |

| Bonus/PF/ESI | Clause 20/26 | Section 49 (The new 43B) |

| TDS Non-Compliance | Clause 21(b) | Section 49 read with Section 393 |

| Cash Payments (>10k) | Clause 21(d) | Section 50 (Old 40A(3)) |

3. The “Accountant” Responsibility

The 2025 Act places a heavy premium on the quality of the audit. Under the new law, the definition of an “accountant” for signing the tax audit report is strictly governed by Section 515(3)(b). For students, this means your “Professional Ethics” and “Tax Audit” subjects are now more integrated than ever.

🚀 Strategic Exam Tip for May 2027:

When solving a PGBP sum, always check if the Turnover limits under Section 63 are crossed (₹1 Cr for Business / ₹50 Lakhs for Profession). If yes, conclude your answer by mentioning that the assessee must also furnish Form 3CD. This shows the examiner you have “Practical Perspective.”

4. Articleship: Your Secret Weapon

Don’t just “unlearn” your articleship work. Re-label it. Every time you report an interest disallowance to a MSME (Clause 22), remind yourself that the MSME Act interest is now reported under the 2025 Act framework. This “active recall” is the best way to study without opening a book.

Source link