The Ultimate Brand Strategy Guide: Metrics CMOs Must Track

The Best Guide To Brand Strategy: Metrics CMOs Must Track

Brand strategy is back at the center of growth conversations, not because it’s trendy, but because everything else has become more expensive. This brand strategy guide will help you understand why it’s more important than ever.

Customer acquisition costs are rising. Performance channels are saturating. Buying cycles are longer, involve more stakeholders, and demand more trust. In this environment, CMOs are being asked a harder question than ever before: How does brand actually contribute to revenue?

For years, branding was treated as a “soft” function. Awareness, impressions, and reach were often reported without a clear line to business outcomes. Meanwhile, performance marketing took center stage because it promised speed, attribution, and measurable ROI. That balance has shifted. Today, CMOs are under pressure not just to grow demand, but to prove that brand strategy creates durable, long-term value.

The problem isn’t that CMOs track too few metrics. It’s that they often track the wrong ones. Many brand reports still focus on activity instead of impact, volume instead of perception, and short-term spikes instead of long-term demand signals.

This brand strategy guide is designed to fix that.

Rather than listing every possible brand metric, this guide brings clarity to what actually matters. It explains how brand strategy metrics differ from performance marketing KPIs, which indicators CMOs should prioritize at different stages of growth, and how brand measurement connects to pipeline quality, deal velocity, and revenue outcomes.

If brand strategy is meant to shape how markets perceive you, trust you, and choose you, then brand measurement must reflect exactly that.

Brand strategy succeeds when CMOs track metrics that measure perception, trust, and long-term demand, not just short-term campaign performance.

Struggling with your brand strategy?

Make your brand known and stand out with these marketing solutions.

- Brand strategy metrics are fundamentally different from performance marketing metrics.

- CMOs must prioritize perception, trust, and long-term demand signals.

- Brand metrics are leading indicators of revenue, not vanity numbers.

- The strongest brand strategies connect measurement directly to business outcomes.

Why Brand Strategy Measurement Matters More Than Ever

It is a fact that brand strategy has always influenced growth. The only thing that has changed is how visible its impact has become.

To be fair, as performance efficiency declines, companies can no longer rely solely on paid acquisition to drive predictable growth. Rising CAC, privacy constraints, and channel saturation mean that demand must be earned earlier, before buyers ever click an ad or fill out a form. This is where this brand strategy guide plays a decisive role.

In the B2B market specifically, purchasing decisions are shaped way before the intent signals appear. That is because buyers tend to research independently by consulting peers, reading industry content, and building shortlists based on reputation and credibility. As a result, by the time a sales conversation begins, perception is already formed.

This makes brand measurement a strategic necessity, not a branding exercise.

Brand strategy metrics help CMOs answer questions that performance data cannot:

- Are we trusted in our category?

- Are we perceived as credible, differentiated, and worth a premium?

- Are we influencing consideration before demand becomes explicit?

Therefore, without clear brand performance metrics, CMOs are wasting resources reporting lagging indicators that do not provide the real picture. They can see the pipeline flow, the revenue, and the conversion drop without understanding the forces shaping them upstream.

Branding is vital in today’s market. It acts as a growth multiplier by reducing friction in sales conversations, improving win rates, and shortening deal cycles. However, all these benefits become visible only when CMOs track the right brand strategy KPIs consistently over time.

Measuring brand correctly is no longer about justifying spend. It’s about understanding how growth actually happens.

What CMOs Get Wrong About Brand Metrics

Most brand strategy measurement problems don’t come from a lack of data. They come from misinterpretation.

In today’s market, CMOs often surround themselves with dashboards filled with numbers, yet still struggle to explain how brand contributes to growth. Hence, that disconnect usually traces back to a few recurring mistakes in how to define, select, and report brand metrics.

Confusing Brand Metrics With Campaign KPIs

One of the most common errors is treating brand metrics as if they were campaign metrics.

In detail, clicks, impressions, reach, and frequency are useful for evaluating execution, but they do not measure brand strength. They show what was delivered, not what changed in the market. Therefore, when CMOs rely on campaign KPIs to tell a brand story, they end up reporting activity instead of impact.

True brand strategy metrics focus on shifts in perception, trust, and consideration. These are outcomes that persist after a campaign ends.

Over-Indexing On Awareness Alone

Brand awareness is important, but it is incomplete.

To be precise, high awareness without trust, differentiation, or relevance does not drive growth. In some cases, it even works against the brand by reinforcing a weak or unclear brand positioning strategy. That is why CMOs who report awareness as the primary success metric often struggle to explain why pipeline quality or conversion rates remain flat.

Instead, effective brand measurement looks beyond awareness and examines how buyers feel about the brand once they recognize it.

Reporting Volume Instead Of Meaning

Another trap is volume-based reporting.

More mentions, more traffic, or more engagement do not automatically mean stronger brand equity. That is because without context, these numbers are difficult to interpret and even harder to connect to business outcomes.

Strong brand health metrics emphasize quality over quantity:

- Are the right audiences engaging?

- Is sentiment improving?

- Are associations becoming more aligned with the brand’s strategic positioning?

Treating Brand As A Short-Term Channel

Perhaps the biggest misconception is expecting brand metrics to behave like performance metrics.

By definition, brand impact compounds over time. Measuring it in weekly or campaign-level windows often leads to false conclusions and premature optimization. CMOs who shift to trend-based, long-term brand tracking gain a clearer view of how brand strategy supports sustainable growth.

Brand Strategy Metrics Vs. Performance Marketing Metrics

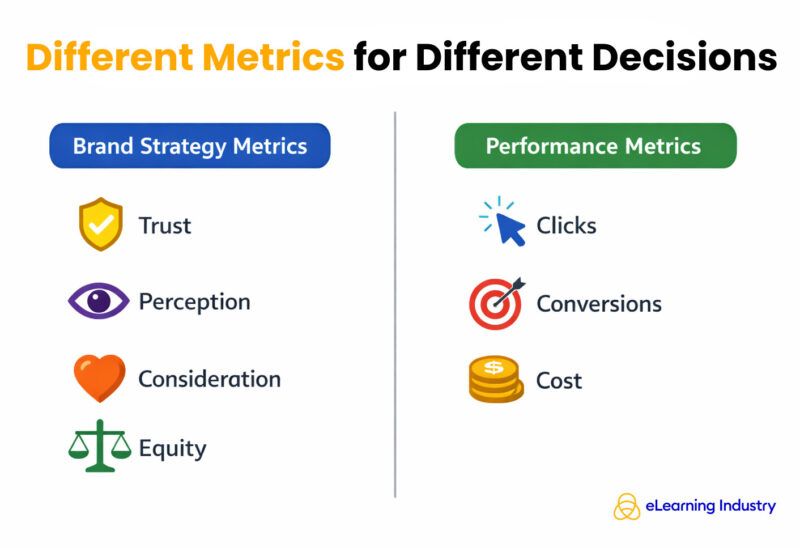

Brand strategy metrics and performance marketing metrics serve different purposes. Companies that confuse them weaken both.

What Brand Strategy Metrics Measure

Brand metrics measure market perception and future demand. They answer questions such as:

- Do buyers trust us?

- Are we seen as credible?

- Are we top of mind when a need arises?

These indicators reflect long-term brand value and act as leading signals of future revenue.

What Performance Marketing Metrics Measure

Performance metrics measure mainly execution efficiency and immediate response. In detail, they track how effectively campaigns convert existing demand into leads, opportunities, or revenue. They are essential for optimization, but they fail to explain why demand exists in the first place.

Why CMOs Need Both

High-performing organizations don’t choose between brand and performance; they align them.

Brand strategy creates demand, preference, and trust upstream. Performance marketing captures and converts that demand downstream. When brand metrics are strong, performance metrics become more efficient. When brand metrics are weak, performance costs rise.

The role of the CMO is to ensure both measurement systems coexist, each informing different decisions.

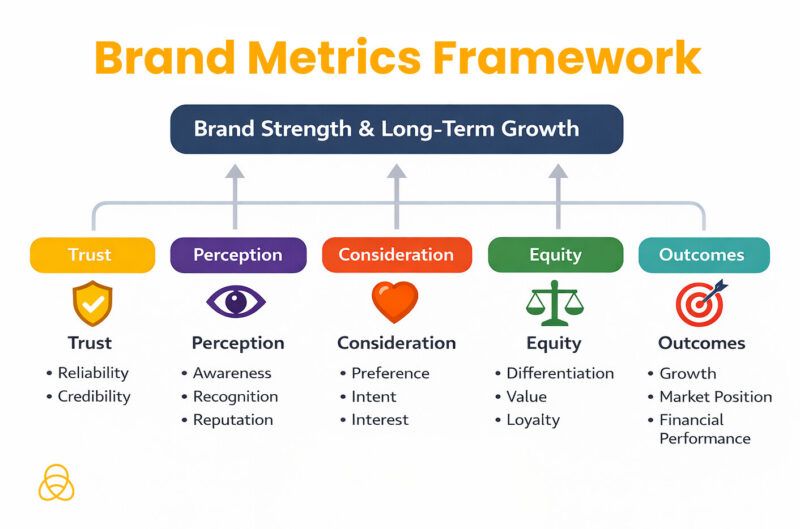

The Core Categories Of Brand Strategy Metrics

If brand strategy measurement feels abstract, it’s usually because metrics aren’t grouped into a clear framework.

Fast-growing companies don’t track dozens of disconnected brand numbers. They organize brand metrics into core categories, each answering a specific strategic question. Together, these categories create a holistic view of brand strength and long-term growth potential.

Below is a brand measurement framework designed to be AI-extractable, board-friendly, and operationally useful.

1. Brand Awareness Metrics

Strategic question: Do the right buyers know we exist?

It is true that brand awareness metrics measure visibility. However, these metrics become meaningful only when you connect them to the correct audience and market context.

Some of the key brand awareness metrics include:

- Unaided awareness: Whether buyers mention the brand without prompts.

- Aided awareness: Whether buyers recognize the brand when shown.

- Share of voice: Brand visibility relative to competitors in key channels.

As we mentioned, awareness alone fails to indicate brand strength. However, without sufficient awareness, downstream brand metrics cannot improve. This makes awareness a necessary, but not sufficient, foundation.

As a result, CMOs should focus their efforts on tracking awareness with market segmentation, not in aggregate, to ensure visibility is growing among priority buyer personas.

2. Brand Perception And Sentiment Metrics

Strategic question: What do buyers think about us?

Perception metrics measure how the market interprets the brand once it is known. These indicators often differentiate high-growth brands from commodity competitors.

Core brand perception metrics include:

- Brand trust

- Favorability

- Strength of associations (e.g., innovation, reliability, expertise)

As a rule, positive sentiment without differentiation is weak. On the other hand, strong perception metrics reflect clarity, credibility, and alignment with strategic positioning.

Therefore, tracking perception over time reveals whether a brand strategy is reinforcing or eroding the intended narrative.

3. Brand Equity Metrics

Strategic question: Does the brand create preference and pricing power?

By definition, brand equity metrics track the tangible value that brand strength creates.

Here are some key brand equity indicators to track:

- Perceived value

- Willingness to pay

- Preference versus competitors

These key metrics influence brand ROI directly, even though the relationship may not be that immediate. As a result, brands with strong brand equity seem to experience higher conversion rates, lower discounting pressure, and stronger resilience in competitive markets like the B2B.

Needless to say, equity metrics are especially important when CMOs need to defend some long-term brand investment decisions.

4. Brand Engagement Metrics

Strategic question: How deeply are buyers interacting with the brand?

Brand engagement metrics should measure quality and depth, not volume.

Some key effective brand engagement indicators include:

- Repeat exposure over time

- Depth of content consumption

- Time spent with high-intent brand assets

In contrast with performance engagement metrics, brand engagement focuses more on a sustained interaction that builds familiarity and trust among your audience. Therefore, a smaller but more engaged audience is often more valuable to your brand than a large and disengaged one.

5. Brand Consideration And Demand Metrics

Strategic question: Are buyers more likely to choose us?

Brand consideration metrics bridge brand strategy and revenue marketing outcomes.

Here are some high-signal indicators:

- Consideration lift

- Branded search volume

- Direct traffic trends

All these metrics mainly reflect active interest that is driven by brand strength, not paid capture. That is why they are among the strongest leading indicators of pipeline quality. When brand consideration rises, sales teams typically report shorter sales cycles and higher-quality inbound demand.

6. Brand Trust And Credibility Signals

Strategic question: Do buyers believe we are a safe, credible choice?

Brand trust metrics are key indicators that often determine whether a brand makes the shortlist.

Some of the key trust and credibility signals include:

- Reviews and ratings

- Thought leadership visibility

- Industry recognition

- Presence in trusted ecosystems

Trust is vital in B2B businesses since it accelerates buying decisions by reducing perceived risk. Especially in complex environments, it often matters way more than awareness or engagement.

How Brand Strategy Metrics Connect To Business Outcomes

B2B companies that want to witness success in the market should understand that brand metrics are not vanity numbers. Instead, they are clear leading indicators of revenue performance. As a result, the strongest CMOs understand that shifts in perception, trust, and consideration directly influence the pipeline and long-term business growth strategies of a company.

In this brand strategy guide, we present the following key connections:

- Pipeline quality: A solid brand perception tends to bring more qualified prospects into the top of the sales funnel. This is because potential buyers who are already familiar with your brand are more likely to engage with it and convert.

- Deal velocity: A trusted and credible brand often leads to shorter sales cycles. That is what most sales teams admit. Therefore, procurement and buying committees often require less time to evaluate solutions.

- Win rates: As a fact, trust and credibility via brand strategy create a preference among your audience. This preference highly increases the likelihood of winning against your competitors. That is because potential buyers tend to select known and trusted vendors for their services over unknown alternatives, even at a premium. Especially in B2B, where the risks are high, buyers value credibility and trust.

- Retention and expansion: Loyalty is a key indicator of a strong brand. Customers are more likely to renew and expand relationships when they believe in your brand’s credibility and value, not only your pricing.

The key takeaway of this section is this: brand strategy metrics are predictive, not just descriptive. Therefore, by monitoring these indicators, CMOs can utilize actionable insights that shape long-term revenue growth, not just short-term marketing wins. This is highly effective and fundamental to a company’s long-term brand success.

Brand Strategy Metrics CMOs Should Report To The Board

The board of your company often does not care for a dashboard of every possible brand metric. Instead, they would value a more focused narrative that tells the real story about impact and trajectory. Here are some things to keep in mind from the brand strategy guide when reporting brand performance to your board:

- Fewer metrics, stronger narrative: Make sure that you highlight the key metrics that truly reflect brand strength. These can be trust, consideration, equity, and demand signals. The more specific, the better.

- Trend-based reporting: Most boards focus on movement over time, not single data points. That is why you should prefer quarterly or biannual snapshots that provide clarity without overwhelming people with information.

- Context over volume: Numbers without context do not tell the real story about the performance. Most boards know this and expect a narrative. Therefore, provide comparative benchmarks, competitive insights, and correlations to revenue outcomes. Showcase what they care about the most.

CMOs who report brand metrics in this way demonstrate strategic insight, not just executional activity, building credibility with leadership.

How Brand Strategy Measurement Evolves As Companies Scale

It is clearly stated in this brand strategy guide that companies that aim for the long-term success of their efforts scale. Moreover, brand measurement follows this evolution.

In short, brand measurement maturity evolves as the company grows. Here are the three main stages for this maturity:

- Early-stage brand signals: This stage includes startups and emerging brands. These brands tend to track awareness and perception among early adopters. In order to identify trends in the market, they use simple surveys and qualitative feedback.

- Growth-stage measurement maturity: As the brand expands, metrics leave the awareness and trend chase to include consideration, engagement, and credibility. At this stage, brands utilize multi-channel surveys, social sentiment analysis, and search trends to provide actionable insights for improvement.

- Enterprise brand health tracking: At this stage, there are large enterprises. These differ the most from companies in the previous stages. For large organizations, brand metrics must integrate with pipeline, win rates, and lifetime value. Moreover, advanced frameworks often connect perception and trust to specific buyer segments, industries, and geographies, supporting the go-to-market strategy across GTM and product teams.

It is vital for CMOs to understand this progression since it ensures that measurement scales with business complexity and keeps the brand strategy actionable in every single stage.

Common Mistakes That Undermine Brand Strategy Measurement

There is no complete brand strategy guide without a list of common pitfalls to avoid. It is no wonder that even the most experienced CMOs can often fall into pitfalls that reduce the effectiveness of a solid brand measurement. Here is a list of common measurement mistakes to avoid:

- Tracking everything: Putting your efforts into collecting too many metrics often dilutes focus. As we stated above, the board and leadership teams need clarity, not clutter.

- No consistent baseline: You need a consistent baseline for your measurements. Without consistent benchmarks, trends are meaningless. Tracking must start with a reliable reference point to tell the real story.

- Short-term measurement windows: Focus on the long-term measurement. Do not forget that brand impact compounds over time. Hence, weekly or monthly fluctuations are often noise, not signal.

- No link to business outcomes: Your board cares about the results. Therefore, metrics without correlation to revenue, pipeline quality, or sales efficiency fail to demonstrate real value.

- Overemphasis on awareness: As we have previously stated, awareness is foundational, but without trust, preference, and consideration, it does not drive decisions.

CMOs who avoid these common mistakes ensure that brand measurement becomes a strategic lever, not just a reporting exercise.

Why Brand Visibility And Credibility Matter In Measurement

As we have mentioned in this brand strategy guide, brand metrics improve when visibility is trusted and contextual. Simply being seen is not enough. Potential buyers must perceive authority, relevance, and credibility.

Key principles include:

- Visibility through trusted ecosystems: Appear where buyers already seek insights, such as industry platforms, forums, research publications, and software listings.

- Thought leadership amplifies perception: Insightful articles, whitepapers, and reports position your brand as an expert rather than a marketer.

- Peer validation accelerates trust: Case studies, customer reviews, and industry recognition reduce perceived risk.

- The strategic loop of visibility, credibility, trust, and demand: Brands that consistently reinforce this loop create long-term market impact, shorten sales cycles, and increase willingness to pay.

Ready to make your brand visible?

Collaborate with our experts in the field and skyrocket your brand strategy.

Conclusion

Brand strategy without measurement is guesswork. Measurement without strategy is noise. CMOs who track the right brand metrics gain clarity on how perception, trust, and credibility drive growth.

By focusing on long-term demand, consideration, and equity, brand measurement becomes a predictive tool that informs GTM, product, and executive decision-making.

CMOs who track the right metrics do not just report results; they shape perception, influence buying decisions, and turn brand strategy into long-term market leadership.

FAQ

Metrics that measure perception, trust, differentiation, and long-term demand rather than short-term performance.

Brand metrics focus on long-term brand impact, while marketing KPIs measure immediate campaign efficiency.

Brand trust, consideration, perceived value, and branded demand are top priorities.

They influence pipeline quality, sales velocity, and conversion rates as leading indicators.

Quarterly or biannually is typical, with a focus on trends rather than short-term spikes.

Awareness measures recognition. Perception measures how buyers feel and think about the brand.

Trust reduces perceived risk, shortens buying cycles, and increases win rates.

Yes, through leading indicators like consideration lift, branded search, and quality engagement.

Early-stage brands track awareness and sentiment, growth-stage brands measure consideration and engagement, enterprise brands connect metrics to revenue and LTV.

Focus on a few key indicators, provide trend-based insights, and connect them to business outcomes.

Tracking too many metrics, short-term reporting, ignoring trust and credibility, and failing to link metrics to revenue.

Visibility must be paired with credibility and trust to influence buying decisions and long-term brand strength.

Source link